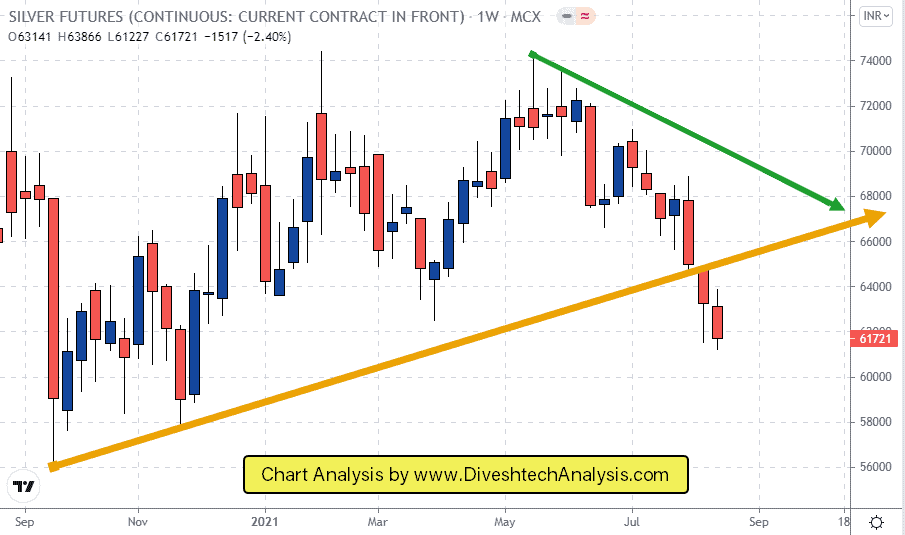

Last week Gold traded higher after breaking the 47200-300 range. But Silver ends the week in a negative tone. It failed to break the 63600-64100 zone and fell over 2500 points.

The Gold levels are the same for the next week. If MCX Gold breaks and sustains above the 47200-300 range, it can go back towards 47800/48300 levels. On the downside, 46900 and 46600 are the key levels.

Below the 63600-800 zone, MCX Silver is weaker and can fall more in the coming days. If soon, it didn’t go above the 63600-800.

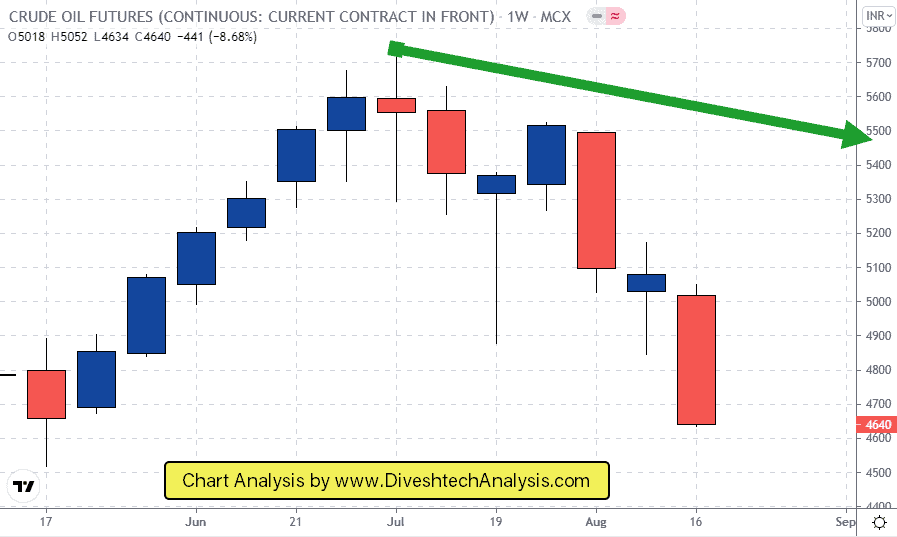

Last week, Crude Oil fell 400 points below the 5030 Gann level. The whole week it kept on falling like anything and didn’t recover a bit.

And the chances of a further drop in MCX Crude Oil are high. It can fall more towards 4580/4500 levels. Around 4500 Oil has strong support. So, over there, it can get support.

MCX Gold Weekly Levels

Next week, 25 & 27 August, are Gann reversal dates for MCX Gold.

Resistance is at 47300 levels; above that, Gold can move towards 47600/48100/48700.

Support is at 46900 levels; below that, MCX Gold can move towards 46600/46100/45500.

MCX Silver Weekly Levels

Next week, 25 & 27 August, are the Gann reversal dates for MCX Silver.

Resistance is at 62300 levels; above that, SilverSilver can move towards 62900/63700/64700.

Support is at 61200 levels; below that, MCX Silver can move towards 60600/59800/58800.

MCX Crude Oil Weekly Levels

Next week, 23 & 26 August, Gann reversal dates for Crude Oil.

Resistance is at 4680 levels; above that, Crude Oil can move towards 4760/4850/4950.

Support is at 4580 levels; below that, MCX Crude Oil can move towards 4500/4410/4310.

Note: The above levels are only for study. Not a Buy/Sell advice.