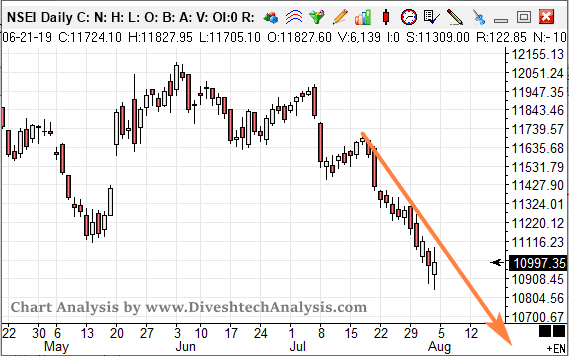

Last week, the Nifty fell below 11200, hitting all three weekly targets. The Index ended the week with a 287-point loss. In the coming week, the Nifty is progressing towards the critical fixed-time cycle period.

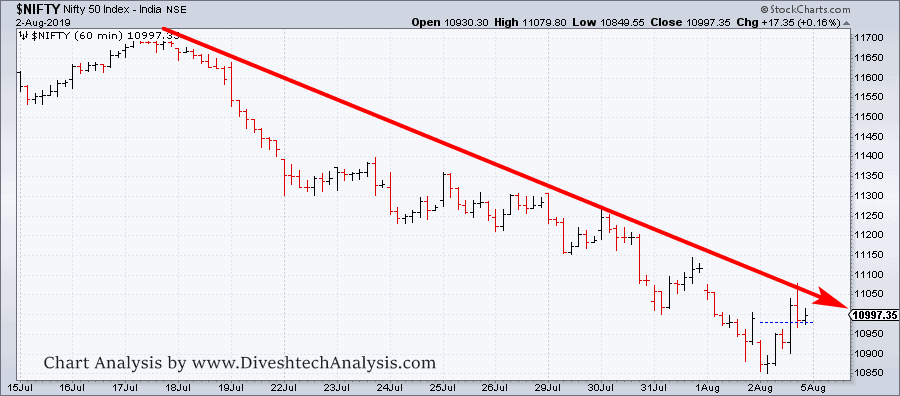

Nifty is getting weak against the angle shown on the hourly chart. Till now, this single angle line has kept with the market’s Major trend by giving multiple Selling points.

On the hourly chart, Nifty bulls need to close above 11055 for the rise towards 11110/11200.

Nifty Bears will get the chance only below 10950 for the move towards 10895/10800.

On the daily chart, buying Forces and energy were active during Thursday and Friday sessions. The move of these two days suggests we can see a bounce in the coming days.

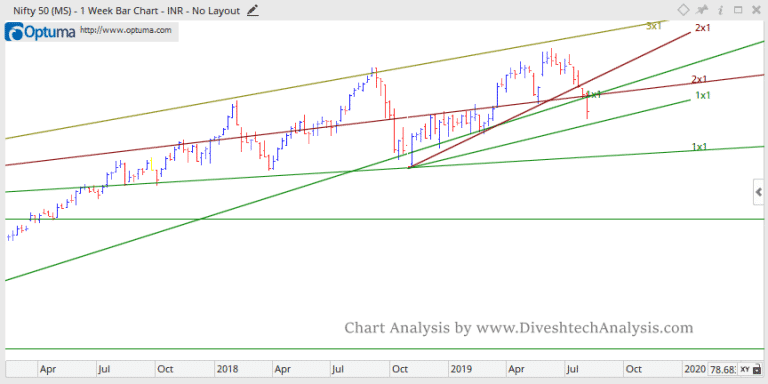

On the chart, I have drawn the unique Gann Angle line. Any Close above that can show us a bounce of 150-200 points.

Nifty Technical Analysis For the Week 05-09 Aug

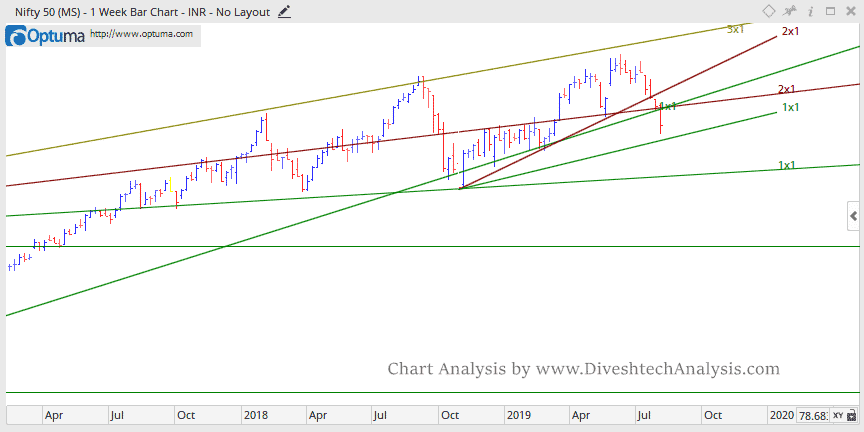

We discussed this section of Nifty Technical Analysis last week. We are trading near the Gann Angle support line. Level 11200 is Support on the weekly charts below, and we can see a further decline in the Nifty.

On the weekly chart, below 11200, the Nifty bears fell 350 points. Now, 10800 is the Critical level for bulls to hold for a bounce-back in August.

In the forthcoming week, 07 & 09 August are the critical dates.

Nifty Weekly Trading Levels

Next week, 11100 will act as Resistance above, indicating a move towards 11160/11230/11365.

While Support is likely to come at, 10950 below that move towards 11890/11820/10780 can be seen.

Note: The above-mentioned price projection & other Information are for educational purposes only.