The Nifty closed last week with a loss of 44 points, while the Bank Nifty closed 380 points higher.

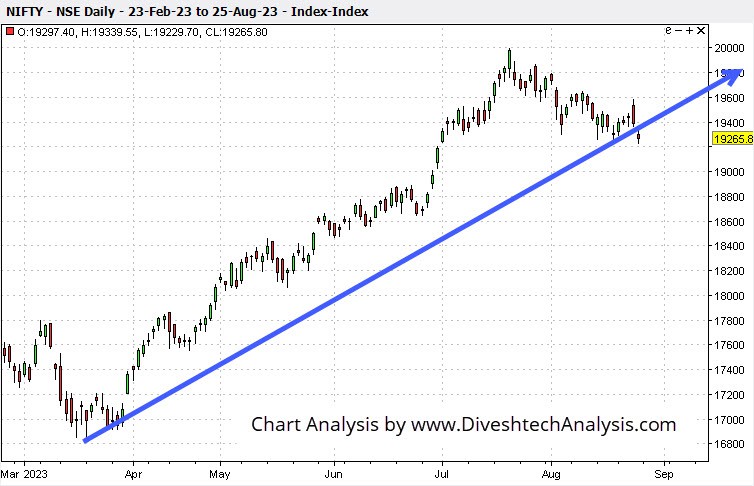

The Nifty’s trend in the coming week will be decided by the 19380 level, which is the significant Gann level. Bears will gain an advantage if they break and sustain below the 19200 Gann Price level.

The Nifty has fallen below its Seasonal Support Point, which is crucial for bulls and could trigger further declines in the Nifty in the coming weeks, more details of which can be found in the video below, along with some additional insights.

Weekly Gann Levels for the Nifty

The 28th & 31st of August are critical Gann dates for Nifty.

A break and hold above the 19380 resistance level could take the Nifty 50 Index higher toward 19480/19590/19700 levels.

Based on the Gann Analysis, the lower support is at 19200. If the Nifty Index breaks and remains below that level, it could decline towards 19080/19010/18880 levels.

In Bank Nifty, the 44400-44600 Gann Price Range is crucial. A sustained rise over the 44600 level will strengthen the Bulls. On the downside, 43700 is crucial.

Weekly Gann Levels for Bank Nifty

The 31st of August is a critical Gann date for the Bank Nifty Index.

A break and hold above the 44600 resistance level could lift the Bank Nifty Index towards the 44800/45100/45500/46000 levels.

Based on the Gann Analysis, the Bank Nifty support is at 44000. If the Bank Nifty Index breaks and remains below that level, it could decline towards 43800/43500/43100/42600.

Note: The above levels are for educational purposes. Not Buy/Sell advice.