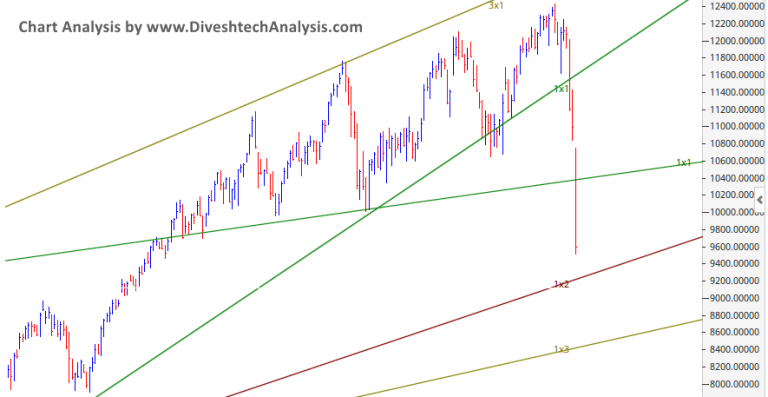

In the last analysis, we discussed. Nifty bulls need the close above 10465-480 range, rise towards 10550/10610/10700 levels. On the lower end, the significant support is at 10260 only. In the case of the gap-down opening, 10075-10050 will act as the next critical support.

Yesterday Index opened gap-down. The high in the Intraday was around 10041, near to our critical Gann support level.

The markets globally turned jittery and went into a tailspin after WHO declared the corona-virus as a pandemic.

The more pain can be seen today in the markets. Now on the lower side, 8700 & 8400 are the two most significant support levels, where this fall can halt.

P.S: I’m not discussing the Intraday levels as, due to Gap-down opening, those levels become meaningless. As the markets will get normalize in the coming weeks will start mentioning it again.