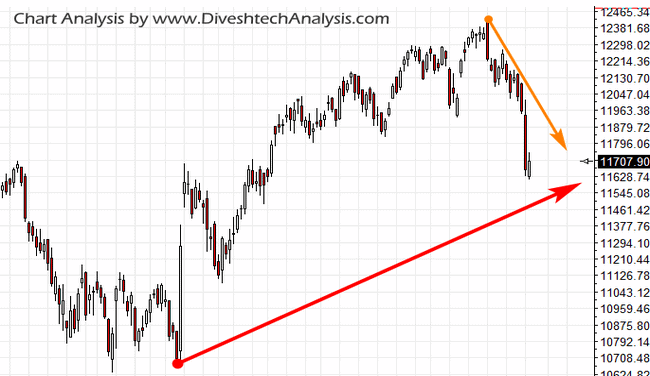

In the last analysis, we discussed. The trading plan for today’s budget session is the same; we should observe if Nifty continues to hold below 11960, then we can expect a further decline in the prices. On the upper side, 12220 will act as the significant resistance for the Nifty Index.

After our last post on the Budget day, Index continues to hold below 11960 in the result of it Bears gets the energy & drag the Nifty towards the lower side. By the end of the day, Index made the low around 11633 levels.

Now moving ahead on Bulls need to break and close above 11895-910 range for getting some strength back.

On the lower side, bears are in a strong position, and we can see further lower levels. On holding below 11620, we can see a new slide towards the 11575/11500 range.

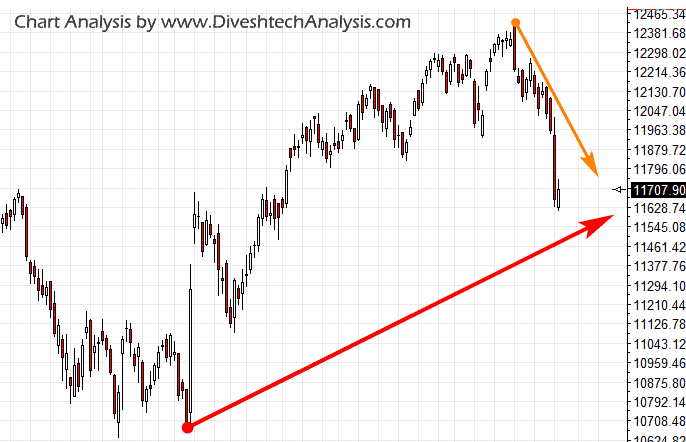

Nifty Intraday Trading Levels for 04th Feb

Resistance for today in Intraday is at 11760 above the move towards 11800/11860/11940 can be seen.

While Support for today is likely to come at, 11680 below that move towards 11640/11580/11500 can be seen.