Last week Gold and Silver fell more. The Gold was showing weakness, the same we discussed in last week’s analysis. Due to Gap down, opening, the hope of bounce in Silver gets neglected.

After making low around 45662 levels, Gold has bounced over 1300 points. Next week, If MCX Gold breaks and sustains above the 47200-300 range, it can show more recovery, or Gold can again revisit 46300/45600 levels.

The 63600-64100 is an important zone for MCX Silver. The Price action near this range (63600-64100) will decide the trend. On the downside, 63100-62900 is the support range.

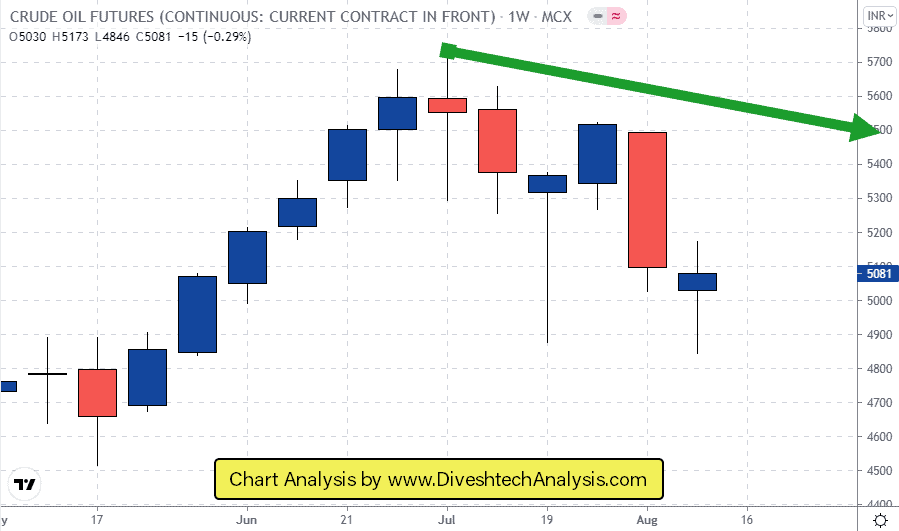

Crude Oil last week dropped 150 points below 4990, and then it jumped towards the 5200 levels. The next week, MCX Crude Oil range is 5200-5030. Either side breakout will decide the trend of the week.

MCX Gold Weekly Levels

Next week, 16 & 18 August, are Gann reversal dates for MCX Gold.

Resistance is at 47200 levels; above that, Gold can move towards 47600/48100/48700.

Support is at 46600 levels; below that, MCX Gold can move towards 46200/45700/45100.

MCX Silver Weekly Levels

Next week, 17 & 20 August, are the Gann reversal dates for MCX Silver.

Resistance is at 64100 levels; above that, SilverSilver can move towards 64700/65400/66200.

Support is at 62900 levels; below that, MCX Silver can move towards 62300/61600/60800.

MCX Crude Oil Weekly Levels

Next week, 16 & 18 August, Gann reversal dates for Crude Oil.

Resistance is at 5200 levels; above that, Crude Oil can move towards 5280/5370/5510.

Support is at 5050 levels; below that, MCX Crude Oil can move towards 4970/4880/4750.

Note: The above levels are only for study. Not a Buy/Sell advice.