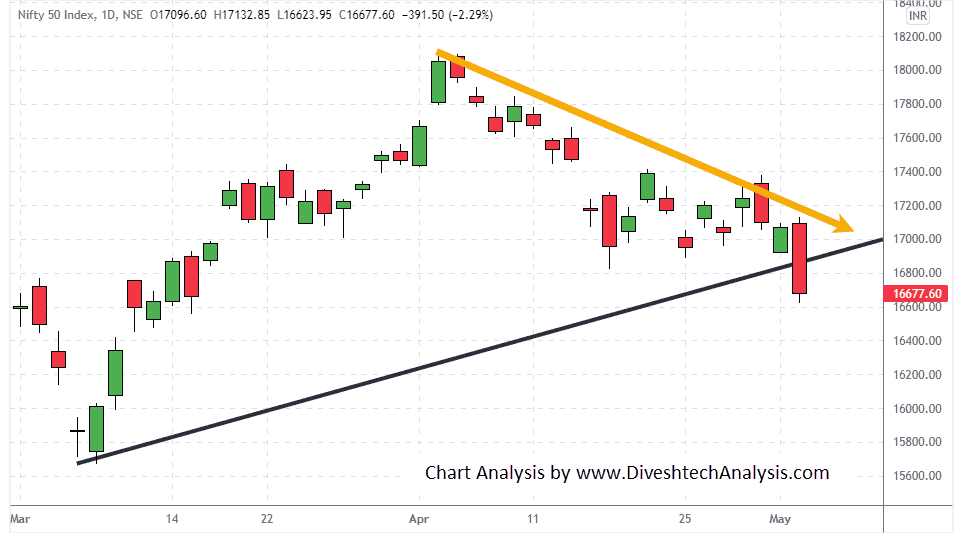

Today both indices opened with a gap-up at the Weekly Gann Square level, which acted as the resistance point. And from there, both indices fell fiercely and closed 2% down.

Until the Nifty is trading below 16900, bears have the upper hand. On the downside, the 16600 is the support. And if Index breaks and holds below that, then it can decline further.

The Bank Nifty closing below 35500 is a worry for bulls as that level was a good support point. So, until Bank Index is below that, it can decline more. On the lower side, 34800 is the next crucial support.

Nifty Intraday Gann levels

Nifty bulls need to break & sustain above 16750 to move towards 16800/16860/16930/17010.

On the lower side, the Gann support level is 16650; below that Index can move towards 16600/16540/16470/16390.

Bank Nifty Intraday Gann levels

Bank Nifty bulls need to break & sustain above 35550 to move towards 35700/35900/36150.

On the lower side, the Gann support level is 35200; below that Bank Nifty Index can move towards 35050/34850/34600.

Note: The above levels are for educational purposes only, not Buy/Sell advice.