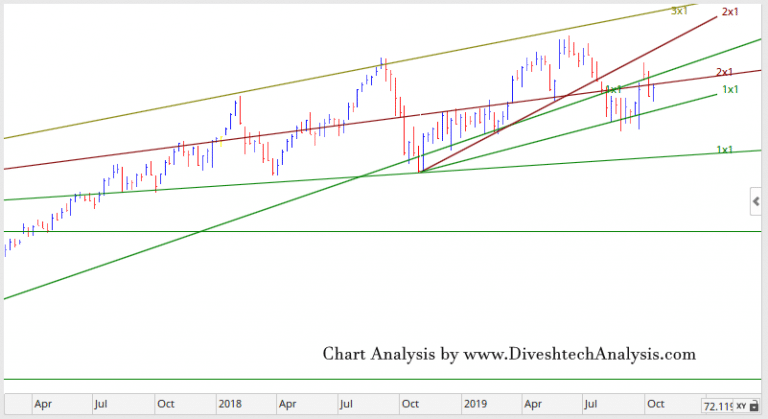

We discussed this in the last Nifty Weekly Analysis post. The Index is soon going to reach one of its critical Time Cycle points, so we can see a trend change and volatile moves.

The Nifty Cycle analysis rewarded us quite well. After the mammoth rally of 1025 points at the end of September, we saw a correction of around 600 points.

As per the Nifty hourly chart, Bulls must trade above 11363 for the up move towards 11425/11515.

On the other hand, Bears will become more powerful below 11190 levels as they move towards 11130/11040 levels.

Last week, the Index made the low near the critical Gann angle line, and we got the bounce.

As per the Daily Chart, bulls will become strong only above 11420, and bears will again become dominant only below 11130.

Nifty Analysis For the 14-18 Oct Week

Until Nifty closes below 11170, bulls are in a balanced position, and a weekly close above 11580 will add more positive action towards the upside.

The critical dates for the forthcoming week, 14 & 16 October, are as follows:

Nifty Weekly Trading Levels

Next week, 11370 will act as Resistance above, indicating a move towards 11430/11510/11650.

While Support is likely to come at 11240, below that, a move towards 11180/11100/10960 can be seen.

Note: The above-mentioned price projection & other Information are for educational purposes only.