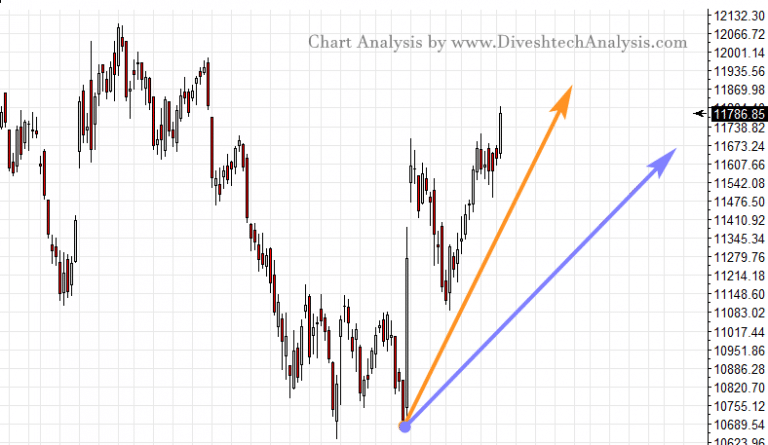

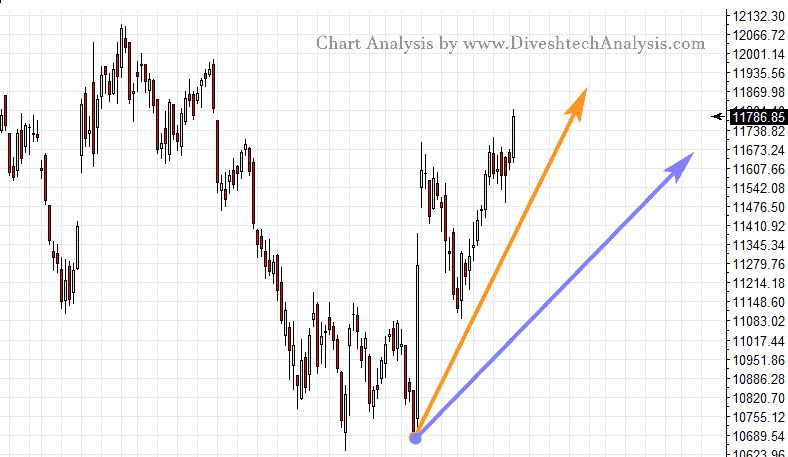

In the last Nifty Analysis, we discussed. The resistance on the upper side has now shifted at 11677 Bulls needs to trade & hold above that for another rally of 70/150 points. On the downside, now the Gann Support level has shifted at 11530-11510 zone. It will act as a short term significant support area.

After our previous analysis, the Nifty Index went below 11510 but failed to sustain below it.

As the result of it, Bulls went above 11677 & we witness the strong rally of 130 points.

Now moving ahead, Nifty bulls need to hold 11745 for maintaining the stable position.

On the upper side, 11853 is the critical Gann resistance level, above that, we can again see the rally of 75/150 points.

Additionally, Nov will be the most critical month for Nifty traders as multiple significant Cycles will get terminated and reach their points during this month.

Nifty Intraday Trading Levels for 30th Oct

Resistance for today in Intraday is at 11820 above the move towards 11860/11920/112020 can seen.

While Support for today is likely to come at, 11740 below that move towards 11700/11640/11540 can be seen.

Note: Above mention Price projection & other Information are for educational purpose only.