In the last Nifty technical outlook post, we discussed that the Bulls need to hold Gann support level 11461 to come back into the game.

On Friday, the Nifty opened flat to a positive note after some consolidation bulls took the Index towards a new day high.

But soon, the bears came back and dragged the Index back towards the new day low. Overall, Friday’s session was like a roller coaster ride.

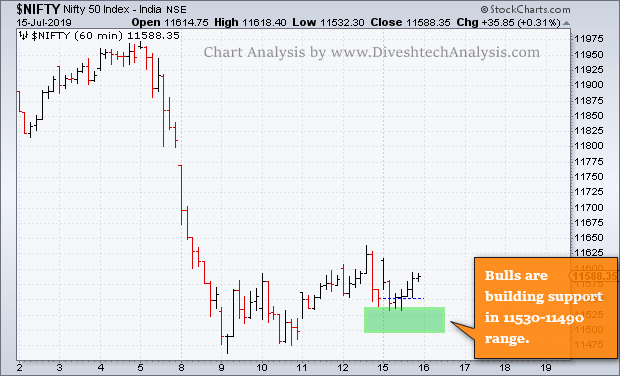

Yesterday, the Nifty opened on a positive note, but it soon gave up all its gains. The high came around 11618 levels.

The positional view for Nifty is the same as that we have already discussed in our last few posts.

Nifty Intraday Technical Outlook

In addition to the hourly chart, Bulls are creating support in the 11530-11490 range. The same can be seen in the above Nifty hourly chart.

The primary Resistance on the upper side is the same at 11765 levels. But before that, level 11655 can also give a tough fight to Nifty bulls.

Nifty Intraday Trading Levels for 16th July

Support for today in Intraday is at 11565/11525/11450 & Resistance is at 11615/11655/11730.

Note: The above-mentioned price projection & other Information are for educational purposes only.