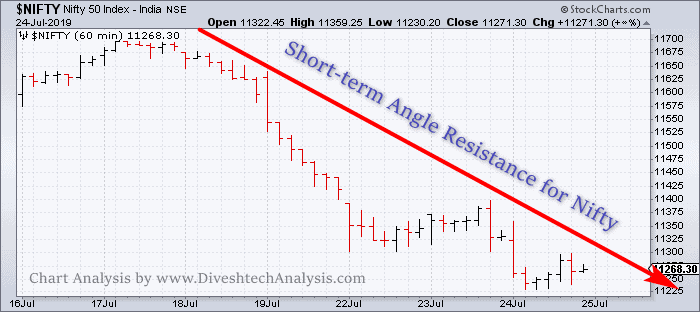

We discussed the last Nifty Intraday trading analysis. The 11314-277 zone will act as short-term support for the Nifty Index. Bears must trade below it for a further 100-150 point free fall. On the upper side, short-term Resistance for the Nifty is at 11495, and the Bulls need to trade above it to regain some strength.

Yesterday, Nifty opened on a flat note, and soon after, the bears continued with the same old story. The Index reached a low of around 11229 levels.

Expiry Day Trading View for Nifty

Bears have the upper hand until we are trading below the 11290-11310 Nifty range.

The 11184/11140 levels in Nifty can be seen on the downside until we are trading below the range mentioned above.

The significant support for Nifty is now at 11140, and we may see some bounce coming from near to it.

Nifty Expiry Day Trading Levels for 25th July

Today’s Intraday support is at 11238/11205/11140, and resistance is at 11310/11340/11415.

Note: The above-mentioned price projection & other Information are for educational purposes only.