Nifty and Bank Nifty both end in green. Both closed near (below) their resistance levels, which we discussed in yesterday’s analysis.

Nifty and Bank Nifty Price action suggests a big move is around the corner.

Nifty bulls need to hold the 15730-700 zone to continue this uptrend from 15513 low. On the higher side, the 15840-50 zone is the resistance.

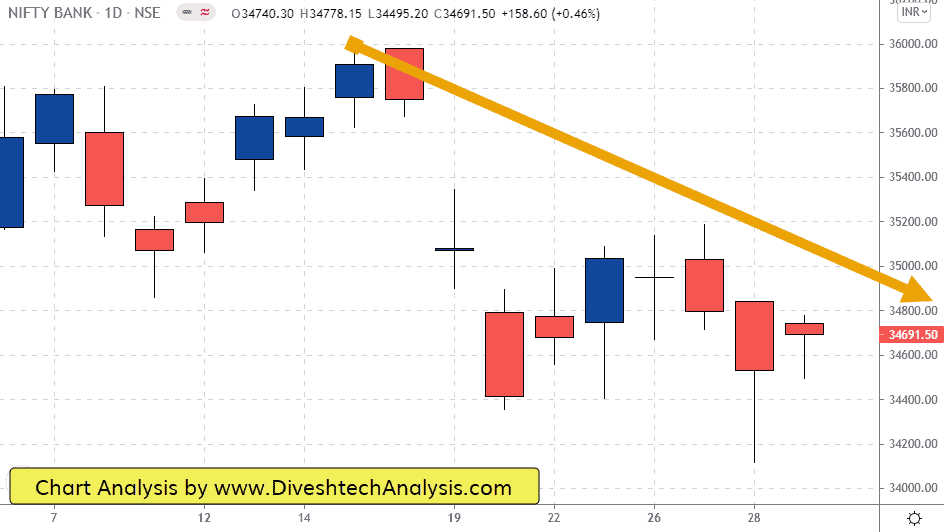

Above 35340-500 zone, Bank Nifty bulls are strong. If Bank Index didn’t hold this 35340-500 zone, then the short-to-medium-term trend may turn bearish. On the higher side, the 34850-990 zone is the resistance.

Nifty Intraday Gann Levels

Nifty bulls need to break & sustain above 15840 to move towards 15880/15930/15990 levels.

On the lower side, the Gann support level is 15760; below that Index can move towards 15720/15670/15610.

Bank Nifty Intraday Gann Levels

Bank Nifty bulls need to break & sustain above 34850 to move towards 34950/35150/35450.

On the lower side, the Gann support level is 34500; below that Bank Nifty Index can move towards 34360/34100/33800 levels.

Note: The above levels are for educational purposes only, not Buy/Sell advice.