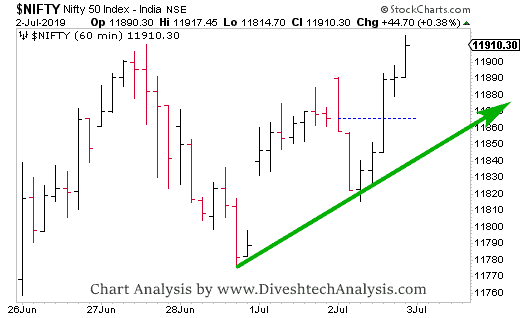

We discussed the last Nifty Analysis for Intraday trading. The view for positional trade is the same; Nifty needs a sustainable move above 11920 for further rise. On the lower side, Gann support for Nifty is at 11750 levels. Bears have their chance only below it.

Yesterday, Nifty opened on a positive note. But soon, it started moving down from near our Intraday Resistance of 11899.

On the downside, Nifty made a low near 11814 and bounced back to the new daily high.

The low came on precisely on the below-shown angle line, which acted as excellent support.

The positional view for Nifty is still the same: Bulls need a sustainable move above 11920, and bears need to move below 11750.

Nifty Analysis for Intraday Trading

The level to watch out for today in Intraday trading will be 11897. If you hold below it, the Bears can gain momentum.

The level to watch for Bulls in Intraday is at 11935 above that we can see a rise in today’s session.

Nifty Intraday Trading Levels for 03rd July

Today’s Intraday support is at 11890/11855/11800, and resistance is at 11935/11970/12030.

Note: Above mention price projection & other Information are for educational purposes only.