Today Nifty & Bank Nifty ends flat on a close-to-close basis. During intraday, indices moved on both sides. First, they opened the gap down, then both did low near the square level, then from there, both jumped 2%, and then came down and ended almost flat.

Let’s discuss the important levels that will help us trade in tomorrow’s session.

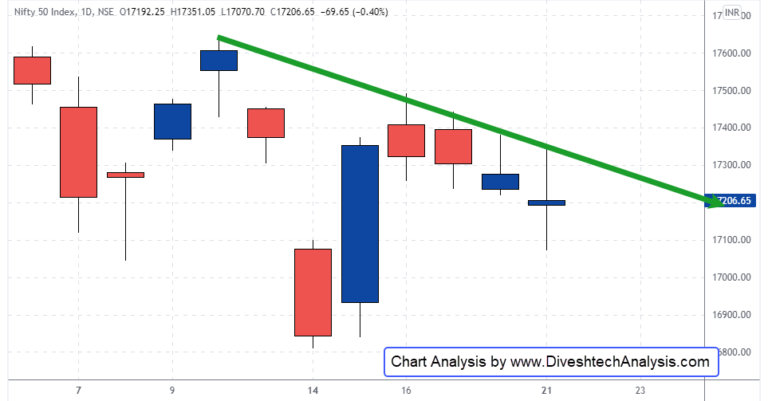

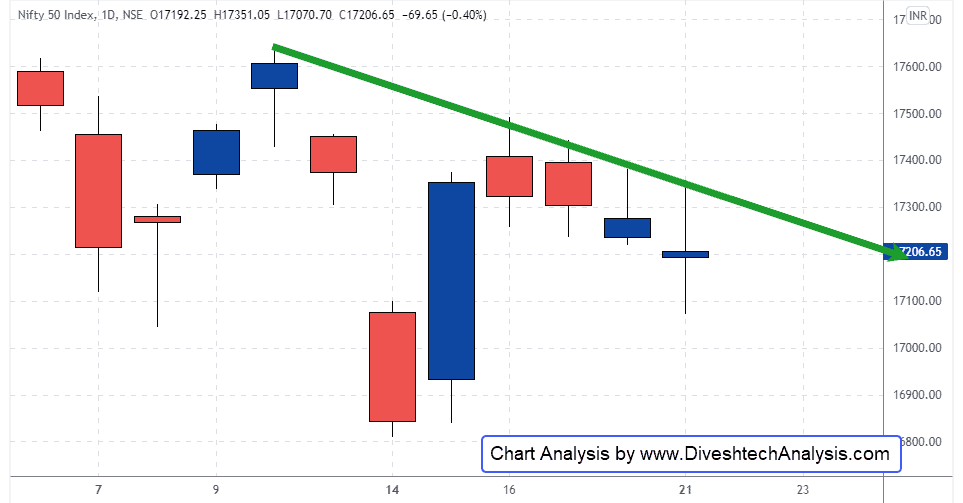

The 17150-140 is a critical support zone. If Nifty breaks & sustains below that zone, it can again fall towards 17070/16980 levels. And on the upside, 17290 is the resistance.

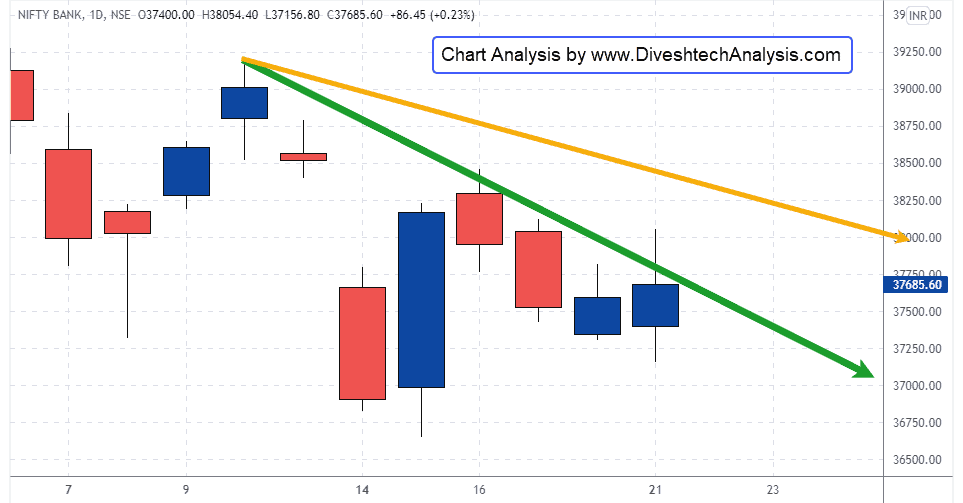

The 37400-300 zone will play an essential role in fixing the Bank Nifty Intraday trend. Below the 37400-300 zone, Bank Index can fall towards 37100/36600 levels.

Subscribe & Get YOUR FREE COPY of the Nifty Cycle Dates Report!!

In ten minutes (or less), discover the important weeks & months for the entire year 2022, where markets can make a swing (high or low). Click here to subscribe and get it right away.

Nifty Intraday Gann Levels

Nifty bulls need to break & sustain above 17230 to move towards 17270/17320/17380/17450.

On the lower side, the Gann support level is 17140; below that Index can move towards 17100/17050/16990/16920.

Bank Nifty Intraday Gann Levels

Bank Nifty bulls need to break & sustain above 37750 to move towards 37900/38100/38350.

On the lower side, the Gann support level is 37400; below that Bank Nifty Index can move towards 37250/37050/36800.

Note: The above levels are for educational purposes only, not Buy/Sell advice.