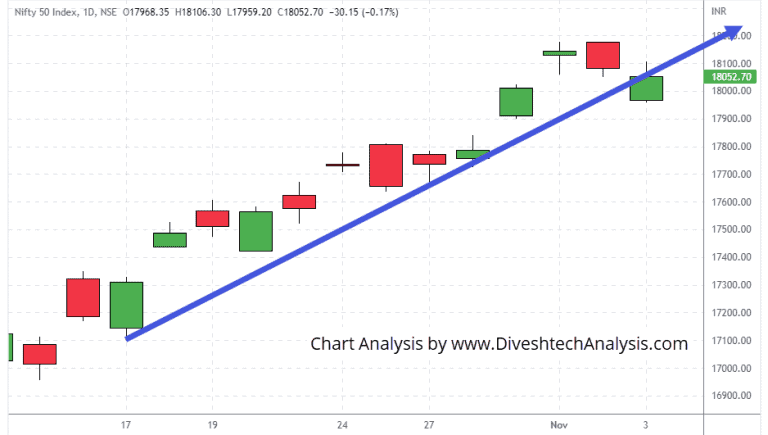

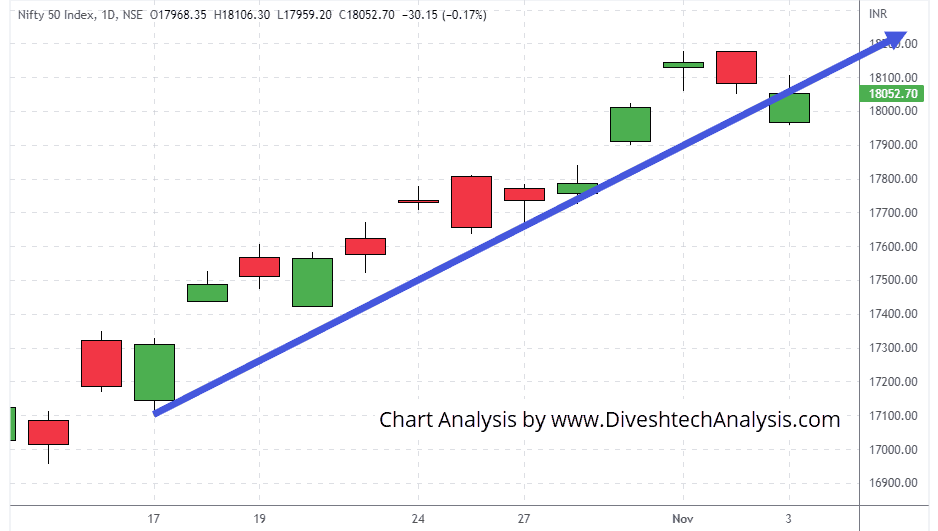

Both indices opened lower today near the SOC Method Support level. Then, both bounced sharply and faced resistance from the SOC Method Resistance level again. And then both traded within a small range for the rest of the session.

Tomorrow, Nifty’s intraday trend will be decided by the 18080-18120 zone, while the 17980-950 zone will act as support.

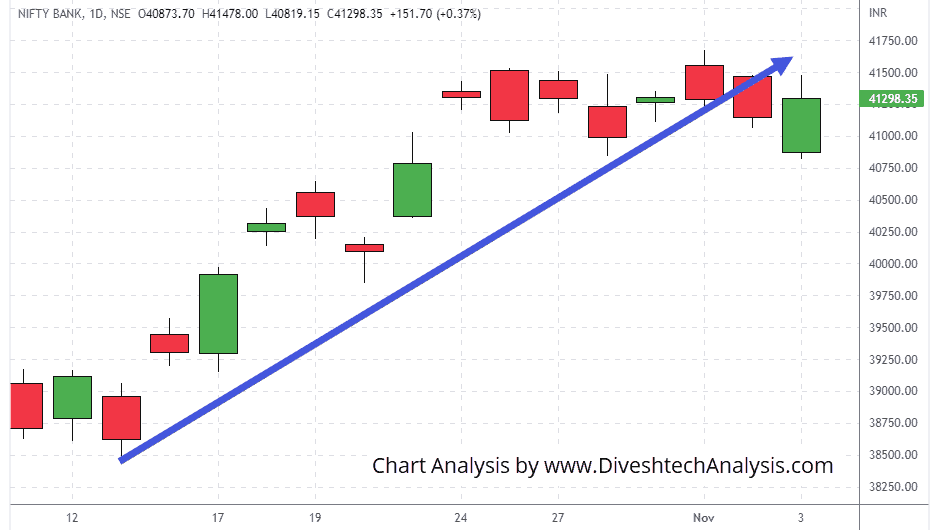

Bank Nifty’s 41100-41600 range is crucial. Any movement on either side will determine the market’s direction. And in case Bank Nifty breaks and sustains below 40800, then it will become weaker and can move further down.

Nifty Intraday Gann levels

A break & hold above 18080 will help Nifty bulls move towards 18120/18170/18230/18300.

The Gann support level is 17980; below that, the Index can move toward 17940/17890/17830/17760.

Bank Nifty Gann levels

Bank Nifty bulls need to break & sustain above 41400 to move towards 41550/41750/42000.

On the lower side, the Gann support level is 41100; below that Bank Nifty Index can move towards 40950/40750/40500.

Note: The above levels are for educational purposes. Not Buy/Sell advice.