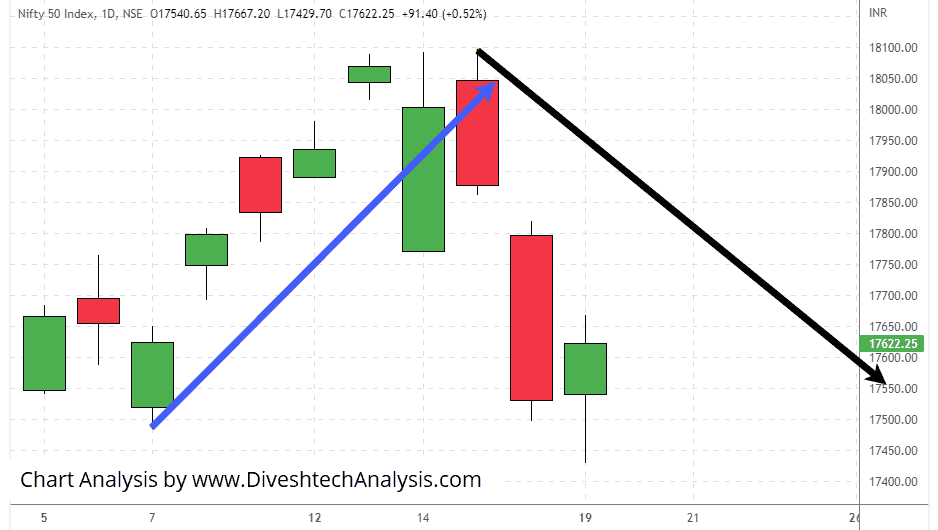

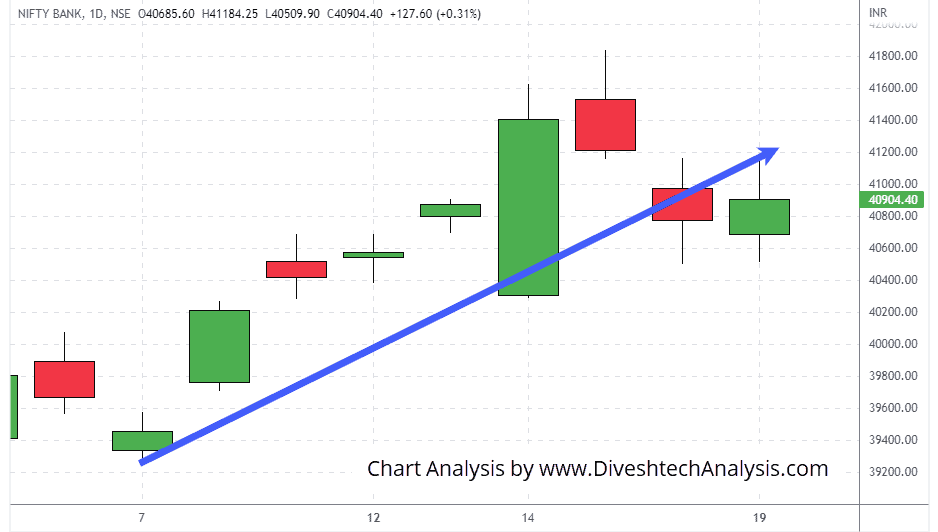

Today both indices opened flat. Then soon, both slumped, but quickly both bounced back and moved higher. After that, both indices traded within a small range and closed in the green.

Tomorrow in Nifty, the 17588-570 zone will play an important role. A sustainable move below that zone can retake the index to lower levels. And on the higher side, the 17670-680 area is the resistance.

And in Bank Nifty 40600-500 zone is crucial. If Bank Index holds below that zone, then it can move lower. On the higher side, 41150 & 41500 are the resistances.

Nifty Intraday Gann levels

Nifty bulls need to break & sustain above 17670 to move towards 17710/17760/17820/17890.

On the lower side, the Gann support level is 17570; below that Index can move towards 17530/17480/17420/17350.

Bank Nifty Intraday Gann levels

Bank Nifty bulls need to break & sustain above 41150 to move towards 41300/41500/41750.

On the lower side, the Gann support level is 40800; below that Bank Nifty Index can move towards 40650/40450/40200.

Note: The above levels are for educational purposes. Not Buy/Sell advice.