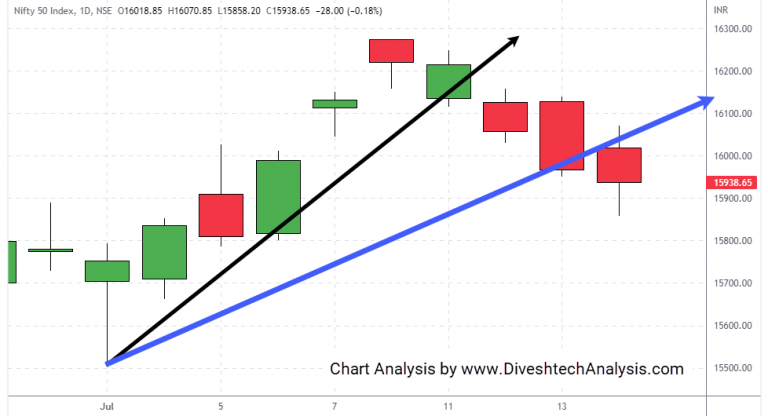

Today both indices opened gap-up. And after consolidation, both moved more upward. But on the higher levels, both indices faced resistance from the Gann square level, and from there, both moved lower, gave up all the gains, and closed in the red.

The 15827-790 is an important support zone for the Nifty. If bulls manage to hold that zone, then a pullback towards 16030/16200 levels can occur.

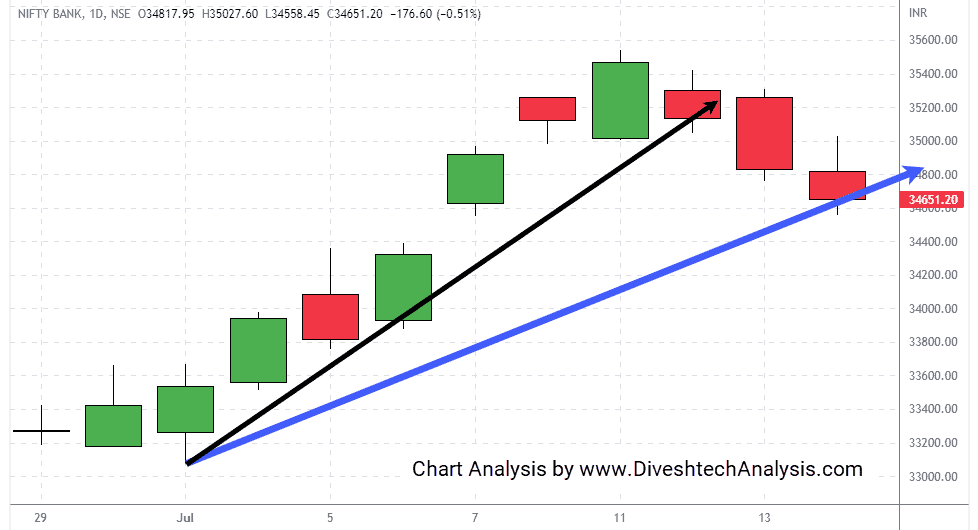

Below the 34750-900 zone, Bank Nifty is weaker. And its range for tomorrow’s session is 34750-34400. So, either side’s breakout with-holding will decide the trend for tomorrow’s session.

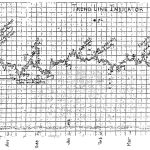

Nifty Intraday Gann levels

Nifty bulls need to break & sustain above 15980 to move towards 16030/16090/16160/16240.

On the lower side, the Gann support level is 15880; below that Index can move towards 15830/15770/15700/15620.

Bank Nifty Intraday Gann levels

Bank Nifty bulls need to break & sustain above 34750 to move towards 34900/35100/35350.

On the lower side, the Gann support level is 34450; below that Bank Nifty Index can move towards 34300/34100/33850.

Note: The above levels are for educational purposes. Not Buy/Sell advice.