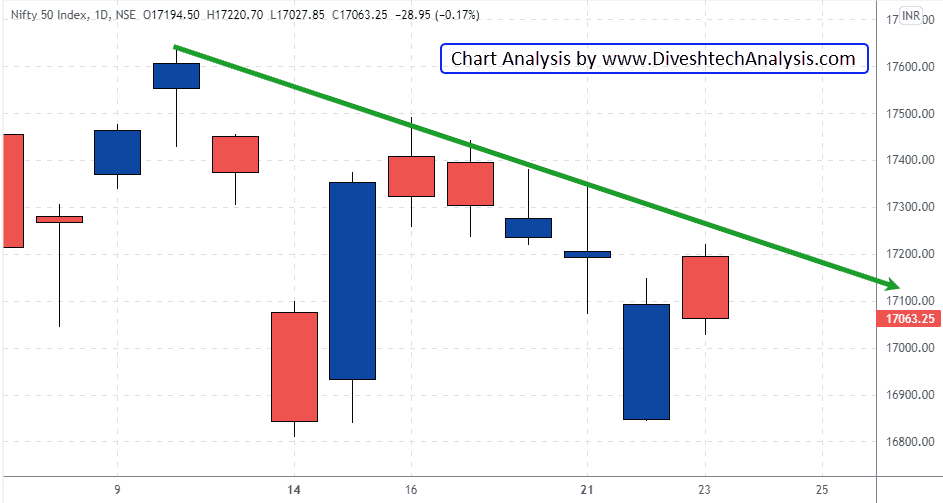

Today Nifty and Bank Nifty open gapped up. Then within a few minutes, both indices moved higher and made the high near Gann Square level. And from that Square level high, both indices moved down and ended the session flat.

Let’s discuss the important levels that will help us trade in tomorrow’s session.

For Nifty, 17160-200 is a crucial resistance zone. And bears are in a strong position until the Nifty 50 Index is not closing or sustaining above that zone. On the downside, 17010 & 16880 are the supports.

Tomorrow, the 37600-200 zone will play a vital role for Bank Nifty. Either side break withholding will decide the trend.

Subscribe & Get YOUR FREE COPY of the Nifty Cycle Dates Report!!

In ten minutes (or less), discover the important weeks & months for the entire year 2022, where markets can make a swing (high or low). Click here to subscribe and get it right away.

Nifty Intraday Gann Levels

Nifty bulls need to break & sustain above 17100 to move towards 17140/17190/17250/17320.

On the lower side, the Gann support level is 17010; below that Index can move towards 16970/16920/16860/16790.

Bank Nifty Intraday Gann Levels

Bank Nifty bulls need to break & sustain above 37550 to move towards 37700/37900/38150.

On the lower side, the Gann support level is 37200; below that Bank Nifty Index can move towards 37050/36850/36600.

Note: The above levels are for educational purposes only, not Buy/Sell advice.