Gann’s Square of Nine

Gann’s Law of Vibration

Gann’s Time Cycle Method

Gann’s Square of 360-degree

Above all the Gann strategies, first, most Gann learners rushed to learn the Gann angles.

They spend thousands of dollars on costly software and invest another 2000 hours in learning how Gann is used to draw angles.

And in the end, they fail.

Yes, they cannot achieve the same result that Gann had with his angles.

And then they quit learning Gann’s angles concept and move ahead, after wasting time and money.

Most Gann learners fail to learn Gann’s angle method because they think WD Gann used ANGLES only by drawing angles on the chart.

And that’s not just 100%, but 1000% wrong.

Gann had many ways to use and apply the Angles on the chart. In this article, we’ll learn one of those ways (method) to use gann angles, and that too without spending 1000s of dollars. So, let’s begin.

First, let’s understand what Gann angles are in simple words.

A gann angle is a geometric tool WD Gann used to find support & resistance and identify the trend’s strength.

To use and draw angles on the charts, Gann used a plastic overlay template, a protractor commonly used in geometry lessons in schools.

Like a protractor has many angles, Gann’s plastic overlay template also has many angles. And out of all the angles, the 1×1 45-degree angle is important.

Gann said, “You can beat the market by trading against the 45° angle alone if you stick to the rule, wait to buy on the 45° angle or wait to sell it against the 45° angle.” – WD Gann.

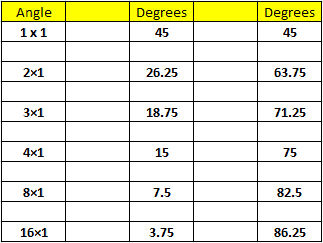

Apart from the 1×1 45° angle, the other important angles are 2×1, 3×1, 4×1, 8×1, and 16×1 angles.

Now, the question is, can we use a plastic overlay template like Gann today?

Yes, we can use the protractor instead of the plastic overlay template.

The next important question emerges: Will we get the same results with angles as Gann does in his trades? The answer is no.

Because Gann used to create charts by hand, which were proper Square charts, in today’s time, we no longer have access to such charts, and no software can construct proper square charts.

We can create charts by hand, but that’s almost impossible because the exercise requires a proper daily commitment of time. So, most of us can’t keep that chart updated.

However, we can still utilise Gann angles to trade the markets with great accuracy. Yes, there is an option and a handy way to use Gann angles.

It’s a mathematical approach. That requires a basic calculation that a 10-year-old kid can do.

It’s not the last dish, but what we’re learning on the way.

In cooking and trading, we rush through things because we’re trying to reach a foolproof zone. But along the way, we forget about the core meaning.

WD Gann was like a master chef. He perfected his knowledge of geometry and mathematics to such an extent that he learned how to adjust things along the way. The same is true of his angle method. He directly applied the degrees of angles as numbers.

We can use the same approach for using angles that work well and deliver excellent results in trading.

So, let’s understand the simple calculation that gann used.

First, we need to convert the 1×1, 2×1, 3×1, 4×1, 8×1, and 16×1 angles into degrees, as shown below. You can save the image for your use.

Next, we need to add or subtract (as per the trend) the angle/degree number(s) from the major tops and bottoms. Then, finally, we’ll determine the price levels that’ll act as support & resistance in the market.

In simple terms, we can use a 45-degree angle or other angles as a number. The same gann did. However, most Gann students missed this view of Gann and began working on complex formulae.

We don’t have to use any complex formula to convert degrees into numbers. We have to use degrees as numbers. And that works fine.

Let’s discuss a few examples to understand how the Gann angle method works in real market charts.

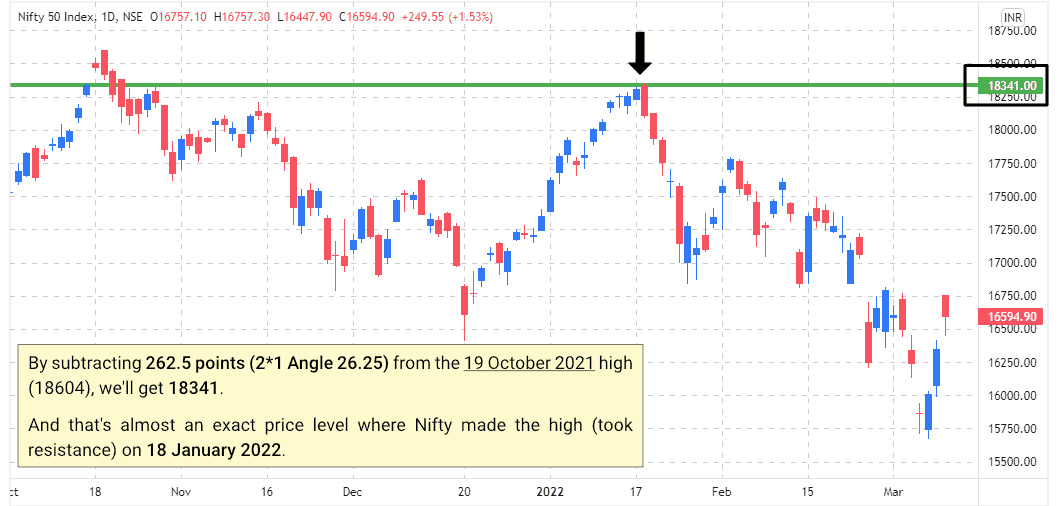

Nifty Gann Angle Calculation: From the 19 October 2021 high (18604), if we subtract 262.5 points (2 x 1 Gann Angle), we’ll get 18341. That’s almost the exact price level that took resistance on January 18, 2022, and fell by 14%.

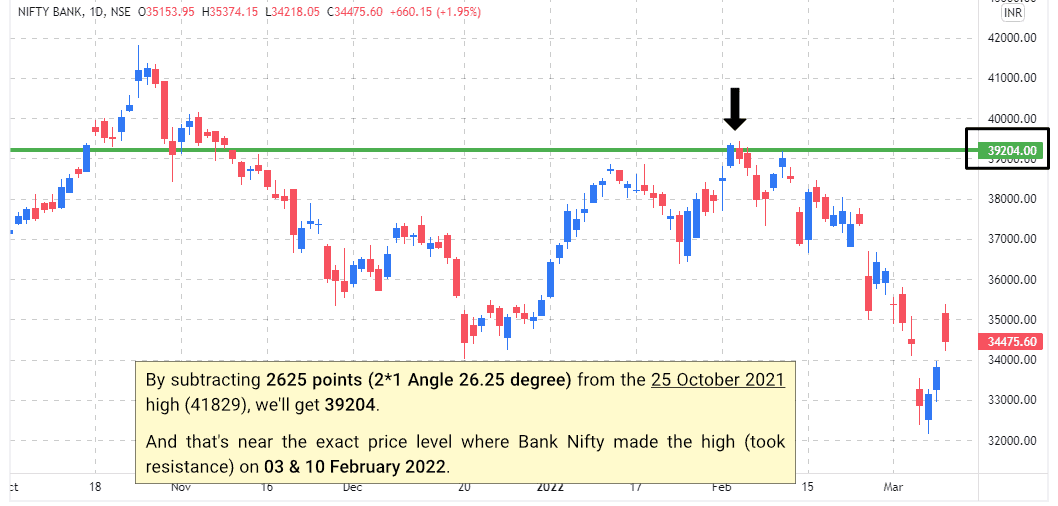

Bank Nifty Gann Angle Calculation: From the 25 October 2021 high (41829), if we subtract 2625 points (2 x 1 Gann Angle), we’ll get 39204. Again, that’s almost the exact price level where the Bank Nifty took resistance on 3 and 10 February and fell 18%.

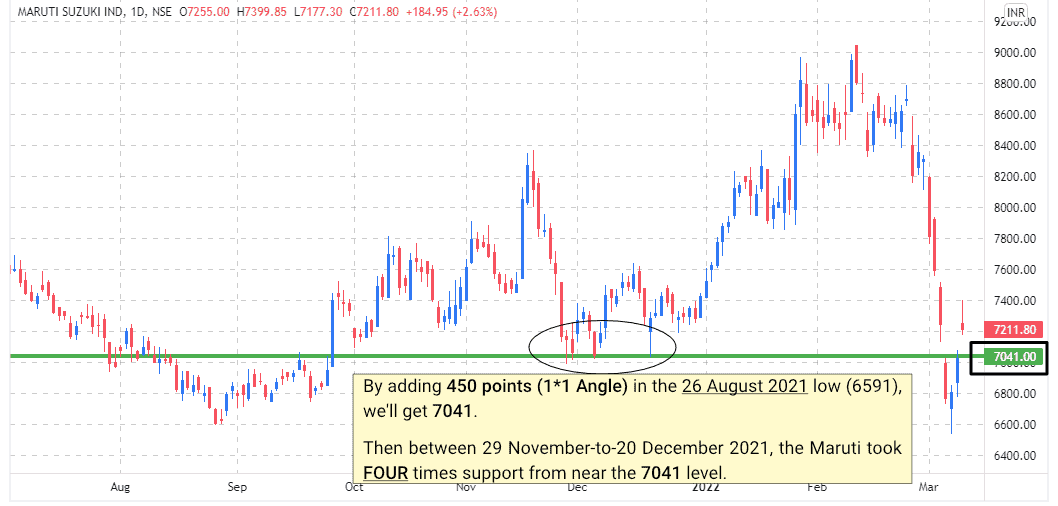

Maruti Gann Angle Calculation: In the 26 August 2021 low (6591), if we add 450 points (1*1 Gann Angle), we’ll get 7041. Then, between 29 November and 20 December 2021, the stock Maruti took support many times from the 7041 level and surged 26%.

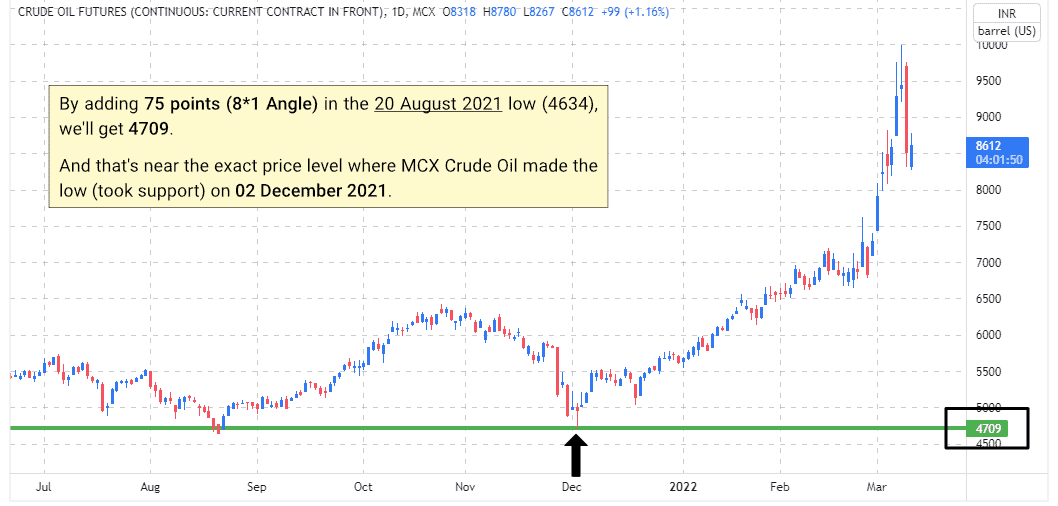

MCX Crude Oil Gann Angle Calculation: In the 20 August 2021 low (4634), if we add 75 points (8*1 Gann Angle), we’ll get 4709. That’s almost the exact price level where MCX Crude Oil took support on December 2, 2021, and surged over 100%.

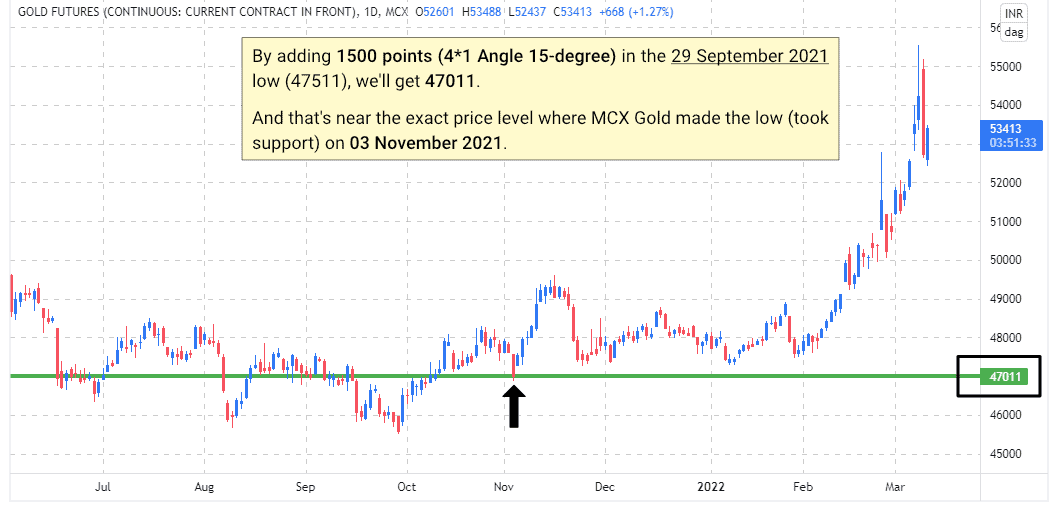

MCX Gold Gann Angle Calculation: In the 29 September 2021 low (47511), if we add 1500 points (4*1 Gann Angle 15-degree), we’ll get 47011. Then, between November 2021 and January 2022, MCX Gold received support multiple times near the 47011 level and surged by 15%.

What’s the one thing you can do today?

Stop spending hard-earned money buying the software just for using the one Gann angle technique. That is a waste of money.

Instead, take the time to practice the Gann angle mathematical method we learned in this article. It will save you money and time.

If you’re serious about understanding the numbers and mathematics behind Gann’s work—not just what’s commonly shared online—our courses are built for you.

We don’t stop at surface-level concepts. We go deep into the numerical patterns, calculations, and market structures that Gann used.

Whether it’s identifying key turning points or forecasting price moves with confidence, you’ll learn how to apply these number-based techniques to real-world trading.

Everything you’ll learn is practical and meant to be used, not just studied.

These courses go deeper than theory. If you want to understand the numbers and mathematical structure behind Gann’s work, feel free to email me at [email protected], and I’ll be happy to help you. – Divesh