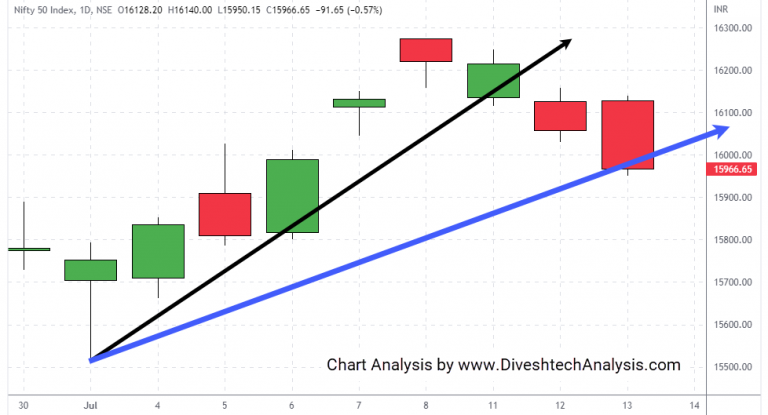

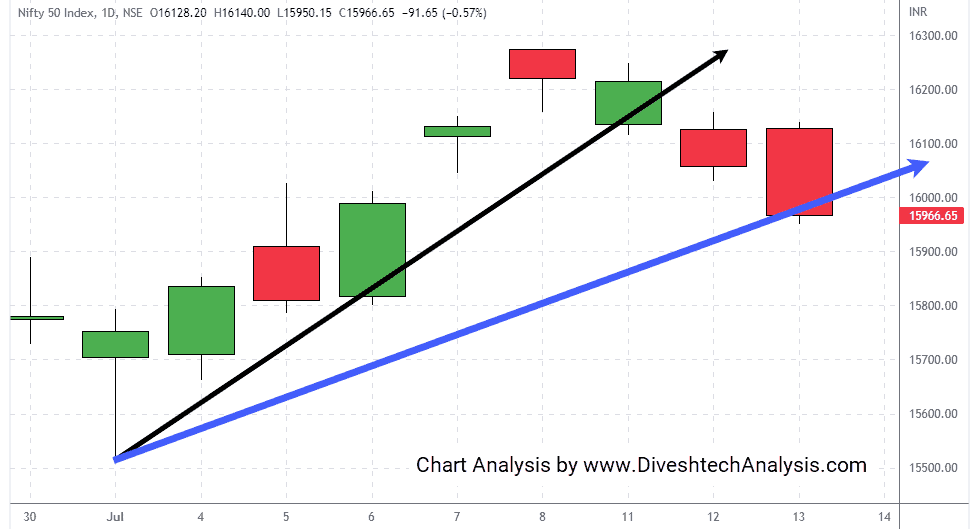

Today both indices opened gap-up. But both failed to maintain the gains. After consolidation, both indices declined, gave up all the opening gains, and ended the day on a weaker note.

The bulls in Nifty are weaker until the Index is trading below the 16015-30 zone. And the chances are high that it may fall further to 15800 levels.

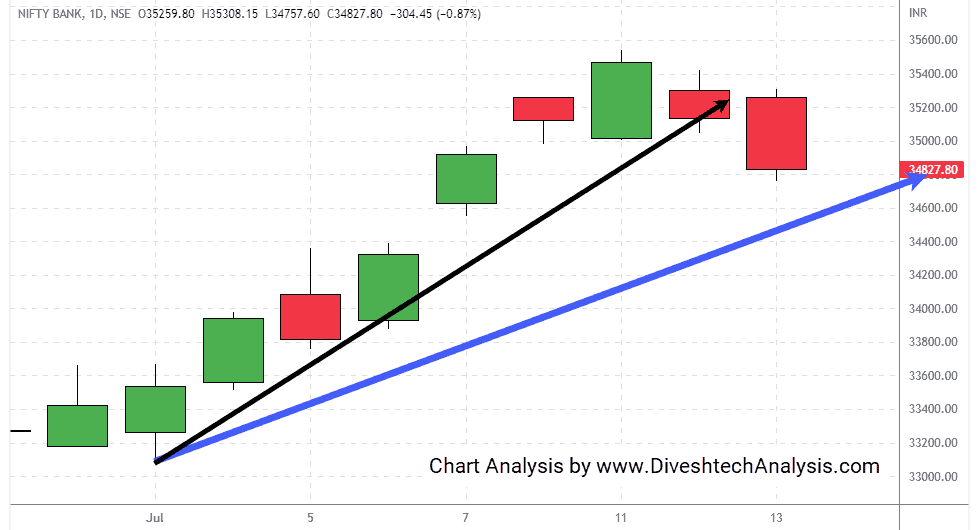

The Bank Nifty is also weaker below the 35000-35050 zone. And its range for tomorrow’s session is 34700-35100. So, either side’s breakout will decide the trend for tomorrow’s session.

Nifty Intraday Gann levels

Nifty bulls need to break & sustain above 16030 to move towards 16070/16120/16180/16250.

On the lower side, the Gann support level is 15950; below that Index can move towards 15910/15860/15800/15730.

Bank Nifty Intraday Gann levels

Bank Nifty bulls need to break & sustain above 35050 to move towards 35200/35400/35650.

On the lower side, the Gann support level is 34700; below that Bank Nifty Index can move towards 34550/34350/34100.

Note: The above levels are for educational purposes. Not Buy/Sell advice.