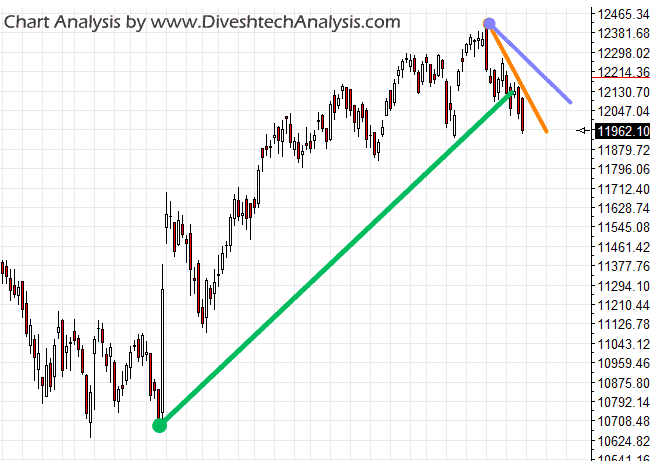

In the last analysis; we discussed. The 12000-11960 Nifty zone can act as a bounce-back area; now, bears need the close below this range for further downside. On the upper side, now resistance has shifted at 12160-170 scales; above that, we can see the move towards 12220/12310 levels.

Yesterday Index opened the gap up and made the high around 12100 levels. From there again, the Bears dragged the market towards the lower side.

By the end of the day, Nifty reached the low around 11945 but gave the closing above the 11960 Gann support level.

The trading plan for today’s budget session is the same; we should observe if Nifty continues to hold below 11960, then we can expect a further decline in the prices.

On the upper side, 12220 will act as the significant resistance for the Nifty Index.

Nifty Intraday Trading Levels for 01st Feb

Resistance for today in Intraday is at 12050 above the move towards 12100/12160/12280 can be seen.

While Support for today is likely to come at, 11940 below that move towards 11890/11830/11710 can be seen.